Com.bot Insurance Quote Bot

Finding the right insurance can feel like a lot to navigate, especially with so many options out there. That’s why Com.bot’s Insurance Quote Bot is here — to simplify the process and help you feel confident in your choice.

This new tool makes the process easier by letting users request insurance quotes through a simple chat interface, compare various plans with interactive carousel cards, and schedule calls with agents effortlessly.

With features designed to save time and improve customer satisfaction, Com.bot can change your insurance experience across different coverage types, including auto, home, and more.

Learn how Com.bot can help you with its benefits, starting from personalized recommendations to improved conversion rates, and learn how it can help businesses optimize their services while ensuring data security.

Key Takeaways:

- Com.bot Insurance Quote Bot simplifies the insurance process by allowing users to request quotes via chat, compare plans with carousel cards, and schedule agent calls automatically.

- Com.bot Insurance Quote Bot helps you save time and effort, offers customized suggestions, improves customer satisfaction, and increases the likelihood of closing sales.

- Com.bot Insurance Quote Bot provides different kinds of insurance, such as car, home, life, health, and business insurance, making it useful for both people and companies.

- 1 What is Com.bot Insurance Quote Bot?

- 2 How Does Com.bot Insurance Quote Bot Work?

- 3 What Are the Benefits of Using Com.bot Insurance Quote Bot?

- 4 What Types of Insurance Does Com.bot Quote Bot Cover?

- 5 How Can Businesses Benefit from Com.bot Insurance Quote Bot?

- 6 What Are the Safety and Security Measures of Com.bot Insurance Quote Bot?

- 7 Frequently Asked Questions

- 7.1 1. What is Com.bot Insurance Quote Bot?

- 7.2 2. How does Com.bot Insurance Quote Bot work?

- 7.3 3. Can I use Com.bot Insurance Quote Bot for any type of insurance?

- 7.4 4. Is Com.bot Insurance Quote Bot free to use?

- 7.5 5. Is my personal information secure when using Com.bot Insurance Quote Bot?

- 7.6 6. Can I speak to a live agent using Com.bot Insurance Quote Bot?

What is Com.bot Insurance Quote Bot?

Com.bot Insurance Quote Bot is a new AI assistant that makes it easy for users to get insurance quotes. Using advanced technology, this tool helps users get quotes quickly and improves their experience in the insurance field.

It lets users chat easily through different online platforms and gives quotes suited to their specific insurance needs.

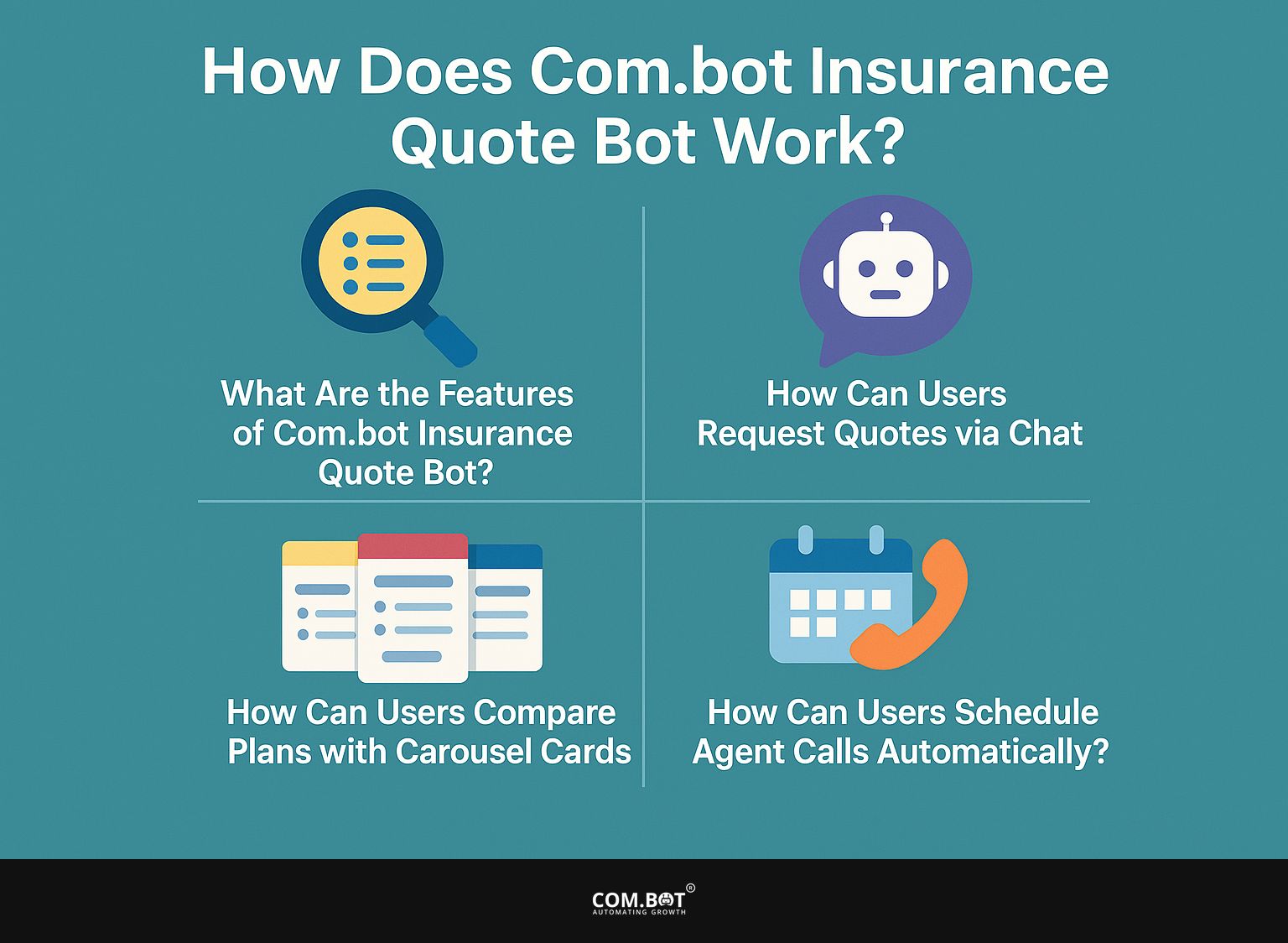

How Does Com.bot Insurance Quote Bot Work?

Com.bot Insurance Quote Bot lets users ask for insurance quotes through chats with its bot on different online platforms.

This AI system collects user data fast, makes sure quotes are correct and suitable for each person’s insurance needs, and includes measures to prevent fraud.

1. What Are the Features of Com.bot Insurance Quote Bot?

Com.bot Insurance Quote Bot offers various features that improve how users interact with it and make the insurance quoting process better. These include templates that can be adjusted to create specific insurance policies, and advanced tools to monitor customer interactions and improve service.

The bot allows users to request quotes by talking, which makes it easy and simple to use. When questions become harder, the system automatically connects users to experienced representatives for immediate help.

The risk assessment tools give users useful information, helping them choose their coverage options wisely. This approach aligns with the principles outlined in our analysis of Com.bot Voice & IVR Bot.

This set of features makes getting quotes easier and helps users feel sure about selecting the right insurance options.

2. How Can Users Request Quotes via Chat?

Users can easily receive insurance quotes by talking with the Com.bot Insurance Quote Bot, an AI assistant. The chat interface improves the user experience and helps customers complete the quote request process smoothly.

When the chat starts, the bot asks users a set of questions to collect important details, including the kind of insurance they want, their personal information, and what coverage they need. This process lets the bot adjust its questions based on earlier answers, creating a simple and smooth experience.

After each reply, the bot quickly collects the necessary details to make accurate quotes. This method makes the process faster and lowers the chance of confusion, which is very useful for people who want quick and clear answers for their insurance needs.

3. How Can Users Compare Plans with Carousel Cards?

Users can compare insurance plans effortlessly using carousel cards, a feature of the Com.bot Insurance Quote Bot that displays competitive quotes side-by-side. This visual approach allows customers to evaluate insurance coverage options quickly and make informed decisions.

These cards show important details clearly, helping people understand insurance policies more easily. They highlight key points like premium costs, deductibles, and coverage limits.

Users can click on each card to get more details about specific policies, showing more information that can help them make decisions. This interactivity increases engagement and helps users consider their options confidently, ensuring they choose the best insurance plan for their needs.

4. How Can Users Schedule Agent Calls Automatically?

The Com.bot Insurance Quote Bot makes it easy to set up calls with agents, so users get help quickly when they need it. This feature is part of a group of functions that automatically improve customer service and the entire insurance process.

By seamlessly integrating an intuitive scheduling system, users can effortlessly book calls at their convenience without the need for back-and-forth communication.

This automatic system reduces waiting times and simplifies the shift from self-service questions to talking with an agent. Customers can choose the time that works best for them, making it simpler to fit into their routines.

People feel much happier when they know they’re in charge of their experience but can still reach out for expert help when needed.

What Are the Benefits of Using Com.bot Insurance Quote Bot?

The Com.bot Insurance Quote Bot helps users get insurance quotes quickly. It reduces the time needed to receive quotes and provides personalized advice for individual insurance needs.

This AI tool is designed to improve customer satisfaction and encourage more people to sign up, which aligns well with Com.bot’s other services, such as the Upsell Recommendation Bot (a solution that efficiently enhances service offerings).

1. Saves Time and Effort

One of the primary advantages of the Com.bot Insurance Quote Bot is its ability to save users both time and effort during the quote request process. By automating interactions, users can quickly obtain insurance quotes without lengthy waiting periods.

This improved efficiency enables users to concentrate on selecting the best quotes instead of spending time on boring administrative work.

Imagine a small business owner who needs multiple quotes for commercial insurance. Typically, this involves lengthy phone calls and many emails.

Using the Quote Bot, they receive several personalized quotes right away, letting them compare options quickly. This reduces work costs and speeds up decision-making, letting users get coverage quickly and easily.

2. Provides Personalized Recommendations

The Com.bot Insurance Quote Bot gives advice suited to each person’s insurance needs, based on the information they provide.

This technology applies complex algorithms to analyze extensive data sets, obtaining detailed information about each user’s particular circumstances.

These algorithms look at factors like age, location, and specific coverage needs. This helps the bot make personalized suggestions that consider the details of each case.

Continuous data processing updates the recommendations instantly, based on changes in the user’s profile or market conditions. This method improves user experience and greatly increases satisfaction, as people get quotes that align better with their personal preferences.

3. Increases Customer Satisfaction

The Com.bot Insurance Quote Bot assists businesses in boosting customer satisfaction by simplifying and enhancing the insurance quoting experience for users. This new tool makes it easy for customers to get quotes and contact insurance companies.

Quick ID checks let users verify their details quickly, leading to faster replies and personalized service. Interactions through computers, such as quick price estimates and personalized policy guidance, make the process better by making sure customers always feel assisted.

Users have praised the bot for its efficiency, with one customer noting, “I was amazed at how quickly I received my quote-it’s truly a game changer in the insurance industry!” Such feedback highlights the positive impact of automation on customer satisfaction.

4. Improves Conversion Rates

Implementing the Com.bot Insurance Quote Bot can lead to improved conversion rates by streamlining the quote request process and providing users with immediate access to insurance solutions.

This immediate interaction meets users’ needs and greatly increases engagement rates, as potential customers get answers to their questions quickly. Businesses utilizing chatbots have reported a noteworthy increase in conversion rates, with some experiencing up to a 30% uplift after integration.

Research indicates that when users stay actively involved, it helps keep customers for longer, resulting in more repeat business and recommendations. The usefulness of these platforms shows how important real-time communication is in today’s quick-moving market.

What Types of Insurance Does Com.bot Quote Bot Cover?

The Com.bot Insurance Quote Bot offers various insurance options to meet different customer needs. Users can use the chatbot to get quotes for car, home, life, health, and business insurance.

1. Auto Insurance

Auto insurance quotes from the Com.bot Insurance Quote Bot offer different coverage choices designed to suit the needs of each driver.

Unlike old methods, users can easily look into various kinds of insurance, like liability, which covers them for damages to others if an accident happens.

Collision coverage helps pay for repairs to your car after an accident, no matter who was at fault. If you want more protection, you can choose coverage that includes events like theft or natural disasters, not just crashes.

The bot’s intuitive interface simplifies the process, allowing drivers to compare these essential options side-by-side, ensuring they make informed decisions that best suit their lifestyle and budget.

2. Home Insurance

Home insurance quotes from the Com.bot Insurance Quote Bot provide important property protection, helping homeowners protect their investments properly.

This protection typically encompasses essential components such as dwelling coverage, which protects the structure itself against various risks, personal property coverage for belongings within the home, and liability coverage that safeguards against potential legal claims.

By utilizing the bot, users can easily tailor their insurance quotes to suit specific needs, enabling them to select the coverage levels and deductibles that align with their unique situations.

This approach makes homeowners feel sure about their insurance choices and helps them understand their options clearly.

3. Life Insurance

The Com.bot Insurance Quote Bot provides users with life insurance quotes that help secure financial protection for their loved ones through various policy options.

With different types of life insurance policies available, individuals can choose between term life, which offers coverage for a specified period, or whole life, which provides lifetime protection along with a savings component. These policies can be customized to fit personal needs, allowing adjustments in coverage amounts and premium payments.

Policyholders should choose their beneficiaries wisely and check that the coverage amounts match their financial goals. This choice is important for the safety and well-being of their dependents if unexpected situations occur.

4. Health Insurance

Users can get health insurance quotes with the Com.bot Insurance Quote Bot, focusing on medical coverage customized to personal health needs.

The bot makes the process easier by providing information about different kinds of health insurance plans available, such as:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- High-deductible plans

Through a user-friendly interface, people can easily compare these plans based on their specific requirements, preferences, and budget.

By showing important details such as premiums, out-of-pocket expenses, and provider networks, the bot helps users choose their healthcare plan by giving them the information they need to pick a plan with the best benefits and access.

5. Business Insurance

The Com.bot Insurance Quote Bot offers business insurance quotes that help companies manage risks associated with their operations and protect their assets.

The bot makes it easier to get important insurance like general liability insurance that protects businesses from claims of harm or damage, and property insurance that covers physical assets from unexpected incidents, which is important for handling risks.

It addresses the need for workers’ compensation, ensuring that employees injured on the job receive necessary medical care and wage replacement.

The bot has an easy-to-use interface that makes it simple for businesses to review different quotes and choose the policies that fit their needs.

How Can Businesses Benefit from Com.bot Insurance Quote Bot?

Companies can benefit from the Com.bot Insurance Quote Bot by making the insurance process easier and improving how smoothly operations function.

This tool improves the ability to draw in potential customers and significantly enhances customer support. Those interested in optimizing customer acquisition further might explore how Com.bot’s solutions, like their SaaS Lead Capture, complement these efforts.

1. Streamlines the Insurance Process

The Com.bot Insurance Quote Bot makes getting insurance quotes easier by handling quote requests automatically and improving user interactions during the customer experience.

This new tool cuts down the amount of manual work agents have to do and provides users with immediate answers to their questions.

This speeds up how fast customers can get information. This results in a smoother experience, where communication continues without breaks, improving overall work performance.

Automatic processes save time and let agents focus on tough issues, making things run more smoothly for everyone.

2. Increases Lead Generation

By incorporating the Com.bot Insurance Quote Bot into their operations, businesses can significantly increase lead generation through improved customer engagement and timely quote delivery.

This new tool uses advanced algorithms to talk to potential clients right away, ensuring questions are answered quickly and completely.

For example, companies have seen a 30% increase in inquiries after adding the bot, enabling fast replies that improve user satisfaction.

By following up with potential leads based on their interactions, the bot nurtures these relationships, guiding inquiries toward a sale. Studies show that companies using this automatic method have higher conversion rates and better customer experiences, which lead to more return visits.

3. Improves Customer Service

The Com.bot Insurance Quote Bot improves customer service by providing users with quick help and solutions to their questions.

As soon as users begin a chat, the bot uses intelligent algorithms to understand their needs and respond. By utilizing natural language processing, it engages in meaningful dialogues, addressing common concerns and providing instant information about various insurance options.

When questions become challenging, the bot promptly links users to a human agent, making sure each conversation is fast and customized for the user’s needs. This easy-to-follow escalation process improves customer service and increases user satisfaction because people feel listened to and appreciated during their experience.

4. Saves Costs on Manpower

Utilizing the Com.bot Insurance Quote Bot allows businesses to save on manpower costs by reducing the need for extensive customer service staff while maintaining high levels of operational efficiency.

This change helps businesses make their processes more efficient and lets them assign employees to tasks that need human involvement.

By automating routine inquiries and quotes, the bot can handle a significant volume of customer interactions seamlessly, freeing up employees to focus on problem-solving and relationship-building. This helps companies improve how customers feel about their service, which leads to stronger loyalty.

Money saved by reducing costs can fund new projects and help businesses quickly respond to changes.

What Are the Safety and Security Measures of Com.bot Insurance Quote Bot?

The Com.bot Insurance Quote Bot uses strong safety and security practices to keep user information safe and support secure transactions.

These practices include encrypting personal details and following data protection laws that protect customer privacy.

1. Encryption of Personal Information

One of the key safety measures employed by the Com.bot Insurance Quote Bot is the encryption of personal information, ensuring that sensitive data remains secure during transactions.

This strong encryption process uses advanced methods like AES (Advanced Encryption Standard) and RSA (Rivest-Shamir-Adleman) to change data into a form that cannot be read by unauthorized people.

By using these technologies, the bot protects personal details like names, addresses, and financial information, building trust among users who depend on digital platforms for service.

Only people who have the correct keys can read encrypted data, making it much more difficult for hackers to get and misuse private messages. Encryption is essential for protecting user data and keeping it private in our online environment.

2. Secure Payment Processing

The Com.bot Insurance Quote Bot guarantees secure payment processing, safeguarding transactions and reducing the risk of fraud during online transactions.

This is achieved through strategic partnerships with reputable payment providers who prioritize security and encryption. By using advanced technology and following industry standards, the bot improves customer trust in their financial dealings.

Various fraud prevention tactics are implemented, including real-time transaction monitoring and multi-factor authentication, which collectively work to identify and mitigate suspicious activities.

By working together, users can get insurance quotes easily, knowing their private information stays safe during the payment process.

3. Regular Security Audits

We regularly review the security of the Com.bot Insurance Quote Bot to follow data protection rules and find any possible security weaknesses.

These audits typically occur on a quarterly basis, allowing for timely detection of any weaknesses before they can be exploited.By carefully checking the bot’s setup and methods, the audit helps protect sensitive user information.

Regular checks help create a habit of constant security awareness, promoting preventive actions instead of reactive ones. Regular checks are important for meeting legal standards and building user trust.

People feel safer when their personal information is checked and improved regularly.

4. Compliance with Data Protection Laws

The Com.bot Insurance Quote Bot is designed to adhere to data protection laws, ensuring that user privacy is a top priority and that all data handling practices meet regulatory standards.

In particular, this bot is committed to complying with relevant regulations such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States.

These laws are essential in establishing clear guidelines on how personal data should be collected, processed, and stored. By following these guidelines, the bot keeps sensitive information safe and establishes trust with users.

This creates a space where people feel safe sharing their data, knowing there are strong measures to keep their privacy safe.

Frequently Asked Questions

1. What is Com.bot Insurance Quote Bot?

Com.bot Insurance Quote Bot is a chatbot that helps users get insurance quotes, compare plans, and set up calls with insurance agents on its own.

2. How does Com.bot Insurance Quote Bot work?

Com.bot Insurance Quote Bot uses chat templates and carousel cards to allow users to easily request insurance quotes and compare plans. It also has the capability to schedule calls with insurance agents.

3. Can I use Com.bot Insurance Quote Bot for any type of insurance?

Yes, Com.bot Insurance Quote Bot can help with quotes and plans for different types of insurance, such as health, life, car, and home insurance.

4. Is Com.bot Insurance Quote Bot free to use?

Yes, Com.bot Insurance Quote Bot is free to use for all users. There are no hidden fees or charges.

5. Is my personal information secure when using Com.bot Insurance Quote Bot?

Yes, Com.bot Insurance Quote Bot takes user privacy and security very seriously. Your personal information is encrypted and stored securely, and only used for the purpose of providing insurance quotes.

6. Can I speak to a live agent using Com.bot Insurance Quote Bot?

Yes, Com.bot Insurance Quote Bot can arrange calls with insurance agents for more help. Alternatively, you can also contact the insurance company directly using the information provided in the quotes.