Com.bot FinTech Alerts Bot

Sure! Here’s a more natural, humanized version in 30 words:

“With the financial world evolving so fast, staying on top of account activity matters more than ever — not just for everyday users, but for fintech companies too.”

The Com.bot FinTech Alerts Bot is a powerful tool designed to deliver real-time alerts -ranging from balance updates to transaction notifications and fraud warnings -directly through secure, encrypted WhatsApp messages.

This article looks at how the Com.bot FinTech Alerts Bot works, its security measures, the benefits it brings to fintech companies, and how it can be seamlessly integrated into existing systems.

Read on to discover how this innovative solution can enhance security and efficiency in the fintech space.

Key Takeaways:

- Com.bot FinTech Alerts Bot provides secure and real-time alerts for balance updates, transactions and fraud warnings through encrypted WhatsApp messages.

- Com.bot FinTech Alerts Bot is fully PCI-DSS compliant, ensuring the highest level of security for fintech firms and their customers.

- Integrating Com.bot FinTech Alerts Bot into their systems can help fintech firms save costs, prevent fraud, and provide a convenient and efficient way to communicate with customers.

- 1 What is Com.bot FinTech Alerts Bot?

- 2 How does Com.bot FinTech Alerts Bot work?

- 3 What types of alerts does Com.bot FinTech Alerts Bot provide?

- 4 Is Com.bot FinTech Alerts Bot PCI-DSS compliant?

- 5 How can fintech firms benefit from using Com.bot FinTech Alerts Bot?

- 6 How can fintech firms integrate Com.bot FinTech Alerts Bot into their systems?

- 7 What are the potential risks or drawbacks of using Com.bot FinTech Alerts Bot?

- 8 Frequently Asked Questions

- 8.1 1. What is Com.bot FinTech Alerts Bot?

- 8.2 2. How does Com.bot FinTech Alerts Bot work?

- 8.3 3. Why should I use Com.bot FinTech Alerts Bot?

- 8.4 4. Is Com.bot FinTech Alerts Bot compliant with industry standards?

- 8.5 5. Can I customize the alerts sent by Com.bot FinTech Alerts Bot?

- 8.6 6. How can I get started with Com.bot FinTech Alerts Bot?

What is Com.bot FinTech Alerts Bot?

Com.bot’s FinTech Alerts Bot improves how customers interact with the finance industry by giving real-time updates through secure and encrypted channels.

This chatbot uses artificial intelligence and machine learning to send custom messages about account balances, transaction history, and spending patterns. It gives users timely alerts that fit their financial goals.

Com.bot uses modern technology to improve how customers get financial information in fintech firms, making it easy to access and engaging.

How does Com.bot FinTech Alerts Bot work?

Com.bot FinTech Alerts Bot uses intelligent technology like natural language processing and machine learning to make discussions about finances simple. This AI chatbot quickly grasps user inquiries, offering quick help and monitoring through a user-friendly interface.

What are the security measures in place for Com.bot FinTech Alerts Bot?

The Com.bot FinTech Alerts Bot uses strong security measures to keep data safe and protect users, following strict rules like PCI DSS and KYC regulations. These protocols safeguard sensitive financial information while providing users with confidence in the system’s fraud detection capabilities, ensuring secure transactions and account inquiries.

Besides using complex coding methods to keep data safe, the platform regularly checks for security issues and assesses weaknesses to find and reduce possible threats.

By utilizing multi-factor authentication, it adds an extra layer of security, ensuring that only authorized users can access their financial data. The bot’s compliance with GDPR highlights its commitment to user privacy, while real-time monitoring safeguards against unauthorized transactions.

With these industry-leading measures, users can trust that their financial activities are handled in accordance with the highest standards in data security and financial regulations.

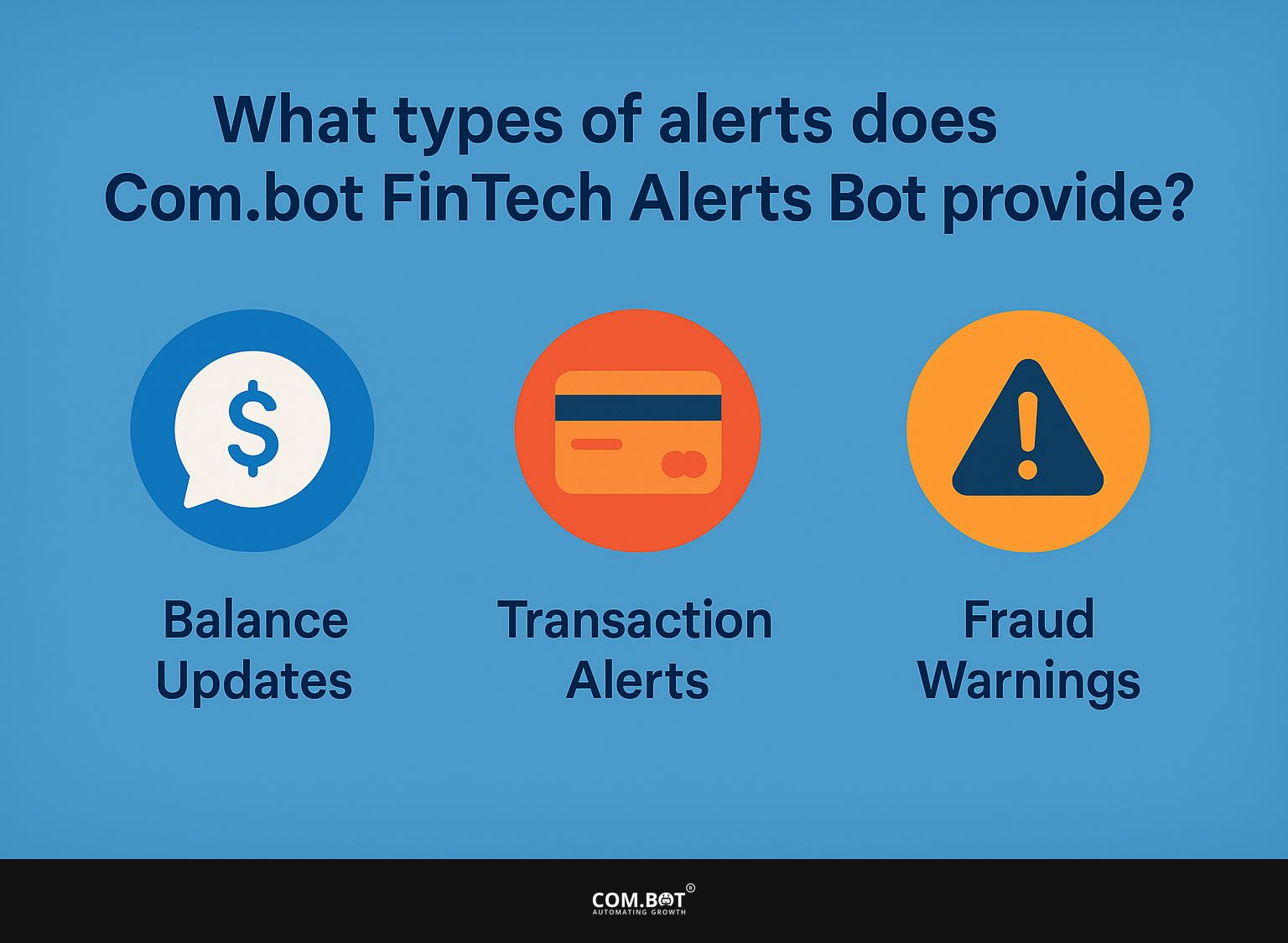

What types of alerts does Com.bot FinTech Alerts Bot provide?

Com.bot FinTech Alerts Bot provides different notifications to keep users informed about their financial activities, like balance changes, transaction updates, and critical fraud warnings.

These notifications give users current information, assisting them in managing their money effectively and achieving their financial goals. For those interested in expanding their knowledge on related services, the Com.bot Retail Payment Alerts offer insights into additional alert types that can further support financial management.

1. How does Com.bot FinTech Alerts Bot send balance updates?

Com.bot FinTech Alerts Bot sends balance updates directly to users via encrypted WhatsApp messages, ensuring timely and secure communication about their financial status. These updates keep users informed about their account balances, helping them make informed decisions that align with their financial goals.

Utilizing end-to-end encryption technology, these messages maintain the highest standards of security while seamlessly integrating into the users’ daily digital interactions.

The process starts with gathering live data from linked banking services, which then provides useful balance information. Afterward, advanced algorithms study spending habits and send custom alerts, ensuring users get notifications related to their financial actions.

This method improves how users interact with the system and meets the need for quick access to tools for handling finances, helping people actively manage their budget and control their expenses.

2. How does Com.bot FinTech Alerts Bot send transaction alerts?

The Com.bot FinTech Alerts Bot provides transaction alerts by analyzing users’ spending habits and sending immediate notifications via secure messaging. This feature improves customer interactions by notifying users of any updates to their transaction history, helping them manage their finances better.

These alerts, created instantly, help users keep track of their financial activities. By receiving timely notifications about purchases, withdrawals, and deposits, individuals can quickly identify unauthorized transactions, helping to mitigate potential fraud.

Users can track their spending over time, helping them make good financial decisions and create realistic budgets. This method of tracking finances improves customer service and gives users confidence, helping them manage their money effectively.

3. How does Com.bot FinTech Alerts Bot send fraud warnings?

Com.bot FinTech Alerts Bot is designed to send timely fraud warnings to users by continuously monitoring account activity and utilizing advanced fraud detection algorithms.

The bot quickly notifies users about any unusual activity, helping keep data safe and avoid losing money. This new tool uses machine learning and pattern recognition to study transaction behaviors instantly, allowing it to tell apart real and fake activities.

The bot’s sophisticated algorithms assess various factors, such as transaction location, amount, and frequency, to detect anomalies that may indicate potential fraud. The proactive monitoring methods make sure that users get instant notifications, allowing them to quickly respond by freezing their accounts or reaching out to their banks.

As online threats continue to change, keeping strong security measures in financial transactions is more important for personal safety and for ensuring trust in online banking systems.

Is Com.bot FinTech Alerts Bot PCI-DSS compliant?

Yes, the Com.bot FinTech Alerts Bot meets PCI-DSS security standards. This means all transactions and data exchanges follow strict rules to protect financial information. This compliance strengthens data security and helps users feel confident that their sensitive financial information is safe.

How can fintech firms benefit from using Com.bot FinTech Alerts Bot?

Fintech companies can gain a lot from using Com.bot’s FinTech Alerts Bot by improving customer happiness and lowering the expenses linked to usual customer service approaches. This AI-based tool helps with tracking performance effectively and managing customer interactions better, which results in greater user involvement and retention.

1. What are the advantages of receiving alerts through encrypted WhatsApp messages?

Getting alerts via secure WhatsApp messages has many benefits, like improved data protection and an easy-to-use approach that matches today’s way of communicating. This method keeps users updated and confident about the safety of their financial information.

A main advantage of using this platform for alerts is that it encourages more user interaction, because people tend to reply faster to messages received on an app they know well.

Because WhatsApp uses end-to-end encryption, it meets privacy standards well, reassuring both businesses and their clients about the security of personal information.

This secure method of communicating with customers offers fast updates and fosters trust, making it an excellent choice for companies aiming to maintain effective communication while staying compliant with regulations.

2. How does Com.bot FinTech Alerts Bot help with fraud prevention?

Com.bot FinTech Alerts Bot aids in fraud prevention by utilizing real-time fraud detection techniques to monitor transactions and proactively alert users of any suspicious activities. This active method greatly lowers the chance of losing money and improves the safety of financial deals.

Equipped with advanced machine learning algorithms, the bot continuously analyzes transaction patterns to identify anomalies that may indicate fraudulent behavior. This feature sends instant warnings for suspicious transactions and improves by learning from previous events to handle new risks.

Users receive alerts through various channels, including push notifications and emails, providing timely information to take appropriate action.

By using advanced analytics, this system can tell the difference between regular changes and real dangers, strengthening financial security and reducing incorrect alerts that might interfere with valid transactions.

3. What are the cost savings for fintech firms when using Com.bot FinTech Alerts Bot?

Fintech firms that implement Com.bot’s FinTech Alerts Bot can experience substantial cost savings by reducing the need for extensive customer service teams and streamlining operational processes. This efficiency allows companies to focus their resources on core business activities while enhancing customer interactions.

By using technology to handle regular tasks and improve work processes, these organizations can significantly reduce their running expenses. As a result, they can use their important staff for key projects that drive growth and new ideas.

Doing less manual work decreases mistakes, leading to accurate and seamless financial processes. Using this technology helps companies save money and improve productivity. These savings can then be used for important aspects such as developing products or marketing.

How can fintech firms integrate Com.bot FinTech Alerts Bot into their systems?

Adding Com.bot FinTech Alerts Bot to current systems is simple, letting fintech companies use a system that can grow and improve how they connect with customers. The setup process is made so businesses can start using the bot quickly without major interruptions.

1. Is there a demo or trial available for Com.bot FinTech Alerts Bot?

Yes, Com.bot offers a demo and trial period for fintech firms interested in exploring the capabilities of the FinTech Alerts Bot. This trial lets businesses try out the bot to improve customer service and make their processes more efficient before deciding to use it fully.

Interested firms can easily access this opportunity by visiting the company’s website, where they can sign up for the trial with just a few clicks. By using the bot in real situations, companies can see how well it works to meet their needs, find any problems, and make customer interactions better.

Trying out the bot before using it completely helps reduce risks and shows how it works. Firms can assess how well the bot integrates with their existing systems, ensuring a seamless transition to these innovative fintech solutions.

2. What support and resources are available for fintech firms using Com.bot FinTech Alerts Bot?

Com.bot offers complete help and resources for financial tech companies using the FinTech Alerts Bot, so businesses can fully improve their interaction with customers and work processes. This includes access to training materials, customer support, and regular updates to improve the bot’s performance.

Companies also have access to training programs created for various user skills, helping teams use the bot’s features well. Technical help is always available, allowing these companies to fix problems and improve the bot’s features as their needs change.

Fintech professionals using the same services create a space where they can share experiences and strategies, leading to new ways to connect with customers. Businesses have plenty of knowledge and tools readily available to fully use this advanced technology.

What are the potential risks or drawbacks of using Com.bot FinTech Alerts Bot?

While Com.bot’s FinTech Alerts Bot offers many benefits, there are possible risks and downsides that fintech companies should consider before using it.

These might include concerns about data safety, how well the bot can handle various customer needs, and the possibility of mistakes in automated interactions.

Frequently Asked Questions

1. What is Com.bot FinTech Alerts Bot?

Com.bot FinTech Alerts Bot is a secure chat flow designed specifically for fintech firms. It sends encrypted WhatsApp messages to provide balance updates, transaction alerts, and fraud warnings, all while being fully PCI-DSS compliant.

2. How does Com.bot FinTech Alerts Bot work?

Com.bot FinTech Alerts Bot integrates with your existing systems and processes to provide timely and secure notifications via WhatsApp. It uses strong encryption to keep private and secure sensitive financial information.

3. Why should I use Com.bot FinTech Alerts Bot?

Com.bot FinTech Alerts Bot is a great tool for fintech companies that want to make their customer communication better and make security stronger. By using WhatsApp, it provides a seamless and secure way to send important information to customers in real-time.

4. Is Com.bot FinTech Alerts Bot compliant with industry standards?

Yes, Com.bot FinTech Alerts Bot is fully compliant with the Payment Card Industry Data Security Standard (PCI-DSS). This means it follows the strict security rules for managing financial information, assuring you and your customers that everything is safe.

5. Can I customize the alerts sent by Com.bot FinTech Alerts Bot?

Yes, Com.bot FinTech Alerts Bot allows for customization of the alerts sent to customers. You can select the notification types you wish to send and customize the messages to match your brand and style.

6. How can I get started with Com.bot FinTech Alerts Bot?

Getting started with Com.bot FinTech Alerts Bot is easy. Simply contact us and our team will work with you to integrate the bot into your systems and set up the alerts you want to send. We offer continuous help to keep everything running smoothly and safely for you and your customers.