Com.bot InsurTech Automation

Insurance is changing fast, and staying on top of it while giving customers great service matters more now than ever.”

Com.bot InsurTech Automation is a tool designed to streamline the insurance process. From pulling real-time rate data via API to generating quote comparisons on WhatsApp By automatically sending renewal alerts, Com.bot changes the way insurers and customers communicate.

This article explains how Com.bot functions and its various features. benefits, potential challenges, and ways to put plans into action, providing information for a more intelligent and effective time ahead for the insurance industry.

Key Takeaways:

- Com.bot InsurTech Automation makes insurance tasks easier and faster, reducing time and expenses for insurers and customers.

- Com.bot gathers rate details from insurance firms, makes quote comparisons in WhatsApp, and sends renewal notices automatically. This speeds up the process and improves accuracy, benefiting customers.

- Companies can implement Com.bot InsurTech Automation by partnering with Com.bot, developing in-house solutions, or utilizing third-party automation tools to stay competitive in the insurance industry.

- 1 What is Com.bot InsurTech Automation?

- 2 How does Com.bot InsurTech Automation work?

- 3 What are the Benefits of Using Com.bot InsurTech Automation?

- 4 How Can Com.bot InsurTech Automation Improve the Insurance Industry?

- 5 What are the Potential Challenges of Using Com.bot InsurTech Automation?

- 6 How Can Companies Implement Com.bot InsurTech Automation?

- 7 Frequently Asked Questions

- 7.1 1. What is Com.bot InsurTech Automation?

- 7.2 2. How does Com.bot InsurTech Automation work?

- 7.3 3. What are the benefits of using Com.bot InsurTech Automation?

- 7.4 4. Is Com.bot InsurTech Automation secure?

- 7.5 5. Can Com.bot InsurTech Automation be customized for different types of insurance?

- 7.6 6. How can I get started with Com.bot InsurTech Automation?

What is Com.bot InsurTech Automation?

Com.bot InsurTech Automation is a new tool that makes work more efficient in the insurance field by using automation and artificial intelligence. Created by Jackson Fregeau, a leader in the industry, this technology simplifies insurance tasks, letting agencies and brokers handle large volumes of work easily.

With a software robot, Com.bot improves data handling and customer processes, ensuring rules are followed and customers have better experiences. This platform will improve how insurance works by supporting digital updates and improving processes.

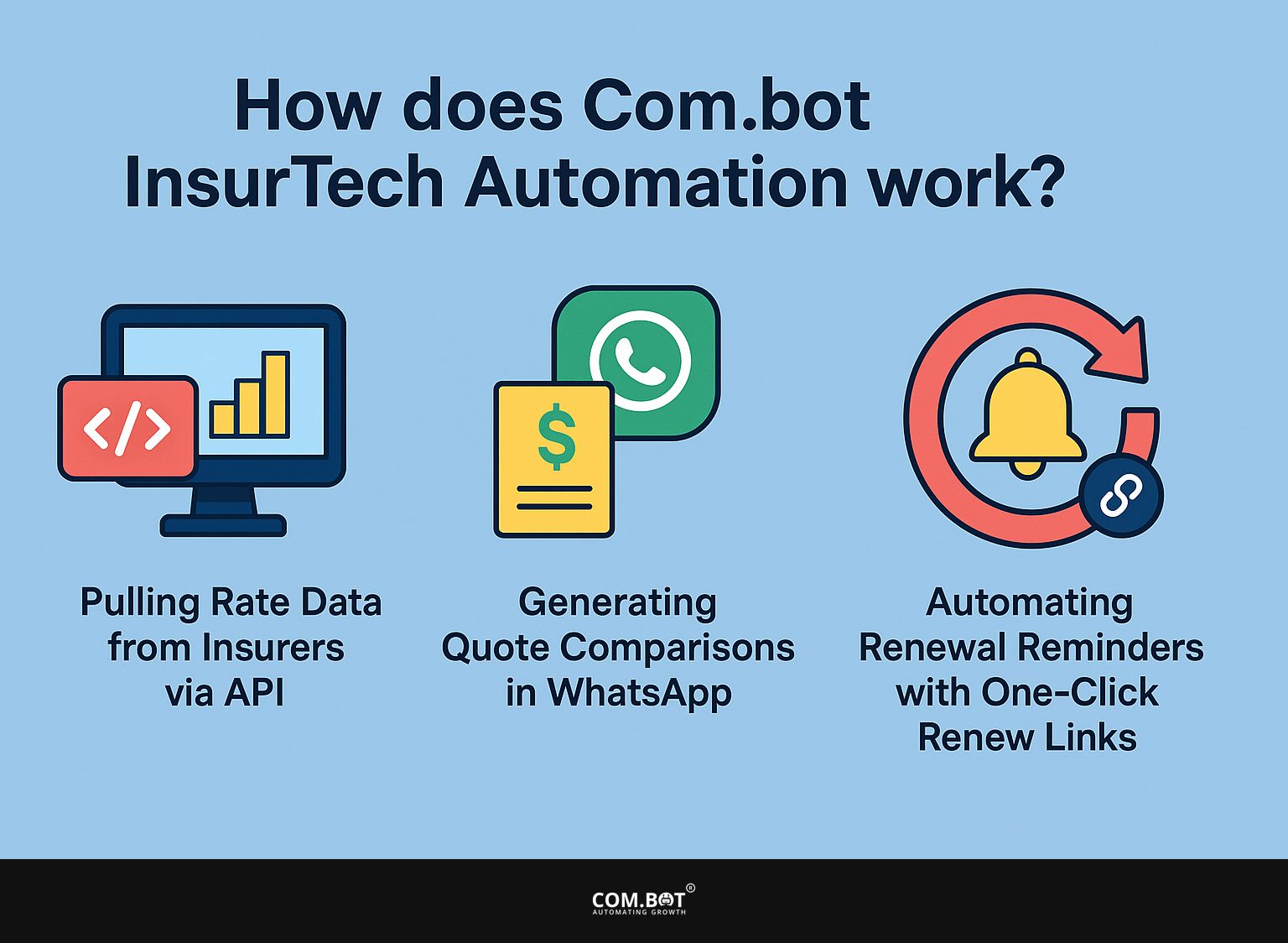

How does Com.bot InsurTech Automation work?

Com.bot InsurTech Automation uses advanced API connections to easily link with insurers and handle important insurance tasks automatically. This modern system processes a large workload, reduces wait times, and offers accurate data extraction and management.

Com.bot uses AI to handle many customer tasks like handling claims and organizing policies. This helps insurance agencies and brokers work more effectively.

1. Pulling Rate Data from Insurers via API

Receiving price information from insurers via API is a fundamental feature of Com.bot’s automatic actions, offering immediate access to essential pricing information in the insurance industry.

This process begins with Com.bot establishing connections to various insurance providers through their APIs, ensuring seamless data exchange and retrieval.

By accessing multiple sources, the platform consolidates the latest rate information, which is essential for brokers and agencies striving to provide their clients with the most competitive quotes.

Managing data effectively in Com.bot makes quoting easier and improves accuracy, reducing mistakes that could cause money problems.

For insurance professionals, this ability means they can react faster to changes in the market and stand out against competitors by providing the best pricing choices.

2. Generating Quote Comparisons in WhatsApp

Comparing quotes in WhatsApp is a feature of Com.bot that makes it easier for customers to view various insurance options.

By using an interface that users already know well, the process becomes easy and natural. This tool lets clients ask questions about their insurance directly in a chat and get quick, relevant answers without needing to browse complicated websites or wait for email responses.

Policyholders can quickly make informed choices and feel well-supported during their buying process. The ease of comparing quotes instantly makes clients happier. They feel confident and assured in their choices, knowing they have all the needed information right away.

3. Automatic Renewal Notices with Quick Renew Links

Com.bot simplifies renewal notices with links that allow insurers and policyholders to renew policies with just one click. This new feature reduces the stress of manual tracking and improves customer onboarding by keeping policyholders informed and involved with their coverage choices.

By facilitating easy access to renewal procedures, it reinforces the importance of maintaining continuous insurance coverage, thus protecting clients from potential lapses that could leave them exposed to unexpected risks.

Timely alerts help policyholders remember renewal dates and make handling their insurance easier. This feature helps make it easier to switch to new policies and improves the connection between insurers and their clients.

What are the Benefits of Using Com.bot InsurTech Automation?

Using Com.bot InsurTech Automation offers clear benefits, like reducing costs, streamlining processes, and increasing customer satisfaction for insurance agencies and brokers.

By taking care of repetitive tasks on its own, Com.bot allows agencies to focus on their main strategies, improving work efficiency and making better use of resources. For a deeper understanding of how Com.bot enhances communication, explore our insights on the Com.bot Voice & IVR Bot.

The use of advanced AI technology makes tasks simpler and helps create a positive experience for customers, leading to more satisfied policyholders.

1. Time and Cost Savings

Time and cost savings are prominent advantages of utilizing Com.bot’s automation in the insurance sector, allowing agencies to significantly reduce operational expenses and allocate resources more effectively. By automating tasks like claims handling and policy administration, agencies can minimize the hours spent on these repetitive processes.

For example, automation allows for quicker claims processing, enabling insurers to respond to customer inquiries and settle claims in a fraction of the time it would take manually. This increases customer satisfaction and lets adjusters concentrate on complicated cases that need human involvement.

By simplifying policy management, insurance workers can maintain correct and efficient handling of client details, resulting in improved financial planning.

By using saved hours for important projects, agencies can put more resources into updating technology or improving customer interactions, supporting lasting growth and strength in a market that is getting more competitive.

2. Increased Efficiency and Accuracy

Com.bot helps with insurance work by making it faster and more accurate. It minimizes human errors and makes routine work easier.

By using complex computer programs, this new tool improves important tasks such as processing claims, deciding on insurance policies, and pulling out information from data, which results in faster completion times and lower running expenses.

Accurately reviewing large data sets ensures that compliance rules are met, preventing costly errors and establishing trust with clients. With these improvements, companies can achieve better results and respond more easily to new regulations.

Consequently, the integration of such technology illustrates a commitment to operational excellence and positions businesses for sustained growth in a competitive market.

3. Enhanced Customer Experience

Com.bot’s system improves customer service for insurers, allowing them to provide faster and more personalized support to policyholders.

Insurance companies can use modern chatbot tools and reply systems to answer questions promptly, lowering wait times and making support more accessible.

This type of interaction helps policyholders feel important and listened to. It also makes communication easier, building trust and reliability. As a result, a growing number of satisfied customers are more likely to remain loyal to their insurers, reinforcing long-term relationships.

Com.bot’s new features help insurance companies meet customer expectations better, increasing satisfaction and changing how they connect with their clients.

How Can Com.bot InsurTech Automation Improve the Insurance Industry?

Com.bot InsurTech Automation can greatly improve the insurance sector by streamlining processes, improving customer communication, and making agencies more competitive.

The industry faces issues such as slow operations and high customer expectations, and using automation tools like Com.bot can lead to major improvements. By applying AI technology and Robotic Process Automation, insurance agencies can better their operations and provide better service to policyholders.

Worth exploring: Com.bot Insurance Quote Bot, which can automate quoting processes and enhance customer satisfaction.

1. Streamlined Processes

Using Com.bot in the insurance field makes tasks smoother and faster by cutting down on wasted time and speeding up how work gets done. Using this advanced technology, companies can handle claims faster and with greater accuracy.

The automation of underwriting processes also minimizes the time agents spend on application evaluations and risk assessments, allowing them to focus on more critical tasks. Customer onboarding becomes smooth, with automatic interactions helping clients through the steps and requirements.

These changes greatly increase the efficiency of operations, helping businesses make better use of their resources and improve customer satisfaction.

2. Improved Customer Engagement

Using Com.bot improves how businesses talk to their customers. Messages sent automatically make communication personal and provide quick replies.

This platform uses automatic communication tools so clients can quickly get answers to their questions, whether they are asking about policy details or claims information. Customers can talk with the bot to get policy recommendations that fit their needs, improving their experience.

Com.bot helps gather feedback by using well-designed surveys that ask clients to share their thoughts and satisfaction after their interactions. This proactive method helps insurance companies find areas to improve, building trust and reliability, and resulting in better client connections and loyalty in the crowded insurance market.

3. Increased Competitiveness

Increased competitiveness among insurance agencies is facilitated by the advanced automation capabilities of Com.bot, offering a distinct market advantage to those who adopt it.

Agencies can use automated tools to shorten the time it takes to help clients, which allows for quicker replies to questions and claims.

For example, an agency using Com.bot can make its claims process faster, cutting the time down from days to just hours. This efficiency reduces operational costs and improves customer satisfaction by giving clients the quick service they expect.

Companies like InsureTech Solutions and SafeGuard Insurance have seen advantages from using such technology, experiencing more customer loyalty and better market standing, which has made them strong competitors in a tough market.

What are the Potential Challenges of Using Com.bot InsurTech Automation?

While Com.bot InsurTech Automation offers many benefits, insurance agencies may face potential challenges, such as connecting with older systems and issues regarding data security and privacy.

1. Integration with Legacy Systems

Integration with legacy systems poses a significant challenge for insurance agencies looking to implement Com.bot’s automation solutions effectively.

Older systems often cannot work with current software, which can cause problems when trying to set up automation tools.

Agencies must carefully assess their current infrastructure and identify any gaps that may exist, as well as consider whether upgrading certain components is essential for achieving optimal performance. The detailed parts of data migration and the possible need for unique interfaces can make the process difficult, so agencies must plan carefully.

By addressing these points early, companies can make transitions easier and get the most out of automation, improving how they operate.

2. Data Security and Privacy Concerns

Data security and privacy concerns are paramount for insurance agencies utilizing Com.bot, as the handling of sensitive customer information requires strict compliance with regulations.

It is important for these agencies to have strong security measures to protect client information and maintain trust and honesty in the industry.

Using automation can make processes more efficient, but it also creates weaknesses that can be targeted by hackers. Therefore, it is very important for insurance companies to create strong compliance plans that include encrypting data, controlling access, and conducting regular audits.

By concentrating on these factors, they can lower risks and make the most of the benefits that systems like Com.bot offer, ensuring a secure setting for the agency and its customers.

3. Resistance to Change

A common challenge for insurance agencies when implementing Com.bot’s automation solutions is that employees might resist using new technologies.

People often feel uncertain because they are worried about losing jobs or changing work routines that have been effective for years. Employees often feel anxious that machines might devalue their work, causing uncertainty about job stability in the coming years. To combat this resistance, agencies can implement strategies that promote an open culture towards technological advancements.

By actively involving staff in talks about the advantages of using automatic processes, such as better efficiency, improved accuracy, and the chance to concentrate on more interesting work, organizations can create a cooperative setting where new ideas are welcomed instead of being avoided.

How Can Companies Implement Com.bot InsurTech Automation?

To set up Com.bot InsurTech Automation, you need a clear plan.

You can work with Com.bot directly, build your own automation systems, or use external automation tools designed for insurance companies.

1. Partnering with Com.bot

Working with Com.bot provides insurance agencies with an easy way to apply automation tools and use the latest technology in their work processes. This partnership offers the chance to benefit from Com.bot’s extensive knowledge and skill in making machines that work automatically for the insurance sector.

Agencies can have ongoing help during the setup process, which helps make the change easier and reduces problems. The flexibility to customize these automation solutions allows agencies to address their unique challenges and operational needs effectively, enhancing efficiency and client satisfaction.

By partnering with Com.bot, insurance agencies can stay competitive and grow by using new automation methods.

2. Developing In-House Automation Solutions

Developing in-house automation solutions provides insurance agencies with the flexibility to tailor Com.bot’s technology to their unique operational requirements and workflows. This method lets organizations customize extensively and change fast to meet new industry standards and client needs.

Developing these solutions involves difficulties and needs a significant investment in technical skills. Teams need the right skills to successfully put plans into action and solve problems, while managing the need for new ideas within the limits of available resources.

Keeping these systems running and improving them can be challenging, requiring continuous training and help as their operations grow.

3. Utilizing Third-Party Automation Tools

Third-party tools can work well with Com.bot’s features, helping insurance agencies improve their current systems and make everything run more smoothly.

Choosing compatible third-party solutions allows agencies to simplify their processes and automatically handle routine tasks, which decreases mistakes made by hand and saves a lot of time.

Agencies need to look at their unique operational needs and goals when thinking about these integrations. Make sure selected tools match their technology setup and align with their long-term plans.

Choosing carefully helps organizations make the most of Com.bot’s abilities, increasing their efficiency and ensuring clients receive quicker and more dependable services.

Frequently Asked Questions

1. What is Com.bot InsurTech Automation?

Com.bot InsurTech Automation is a software platform that uses API technology to make it easier to get insurance quotes, compare rates, and send out renewal notices automatically for customers.

2. How does Com.bot InsurTech Automation work?

Com.bot connects with insurance companies through API integration to retrieve rate data and generate quote comparisons for its users. It makes sending renewal notices automatic and includes a single-click option for easy renewal.

3. What are the benefits of using Com.bot InsurTech Automation?

Com.bot InsurTech Automation helps insurance agents and customers by making it easier to get quotes, compare rates, and send renewal notices. It provides a smoother and quicker process for everyone involved.

4. Is Com.bot InsurTech Automation secure?

Com.bot InsurTech Automation prioritizes security by safeguarding all data and information using secure API connections and encryption. Customer data is also stored securely to protect their privacy and sensitive information.

5. Can Com.bot InsurTech Automation be customized for different types of insurance?

Yes, Com.bot InsurTech Automation can be customized to meet the needs of various insurance types, such as auto, home, and health. The platform is flexible and can be customized to suit the specific needs of each insurance company and their customers.

6. How can I get started with Com.bot InsurTech Automation?

To get started with Com.bot InsurTech Automation, simply reach out to the team at Com.bot and they will guide you through the process of setting up the platform for your insurance business. They will work with you to tailor the platform to your specific needs and provide training and support for a smooth transition.